This post was originally published here.

Having a “financial management system” is key.

Let’s face it. Although most of us have been working from home for the past year, it’s still hard to get through a month without depleting our suweldo.

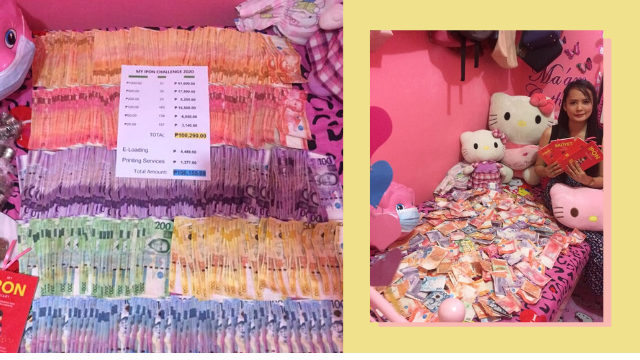

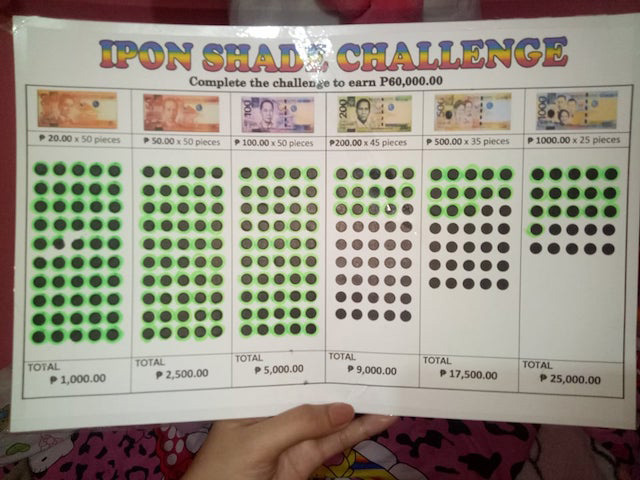

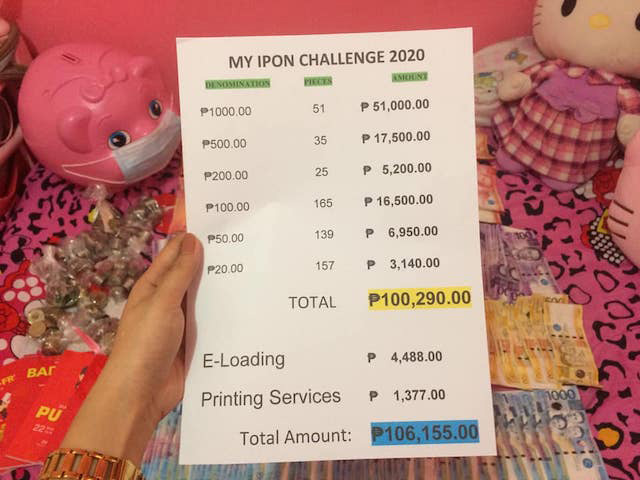

It’s no wonder Cathlyn Mariano, a 27-year-old public school teacher, got netizens saying “sana all” when she uploaded a Facebook post about her savings amounting to P106,155 that she completed in just one year.

Cathlyn, or Cath to her friends, achieved it through anipon challenge that she carried through beginning January 2020 up until January this year.

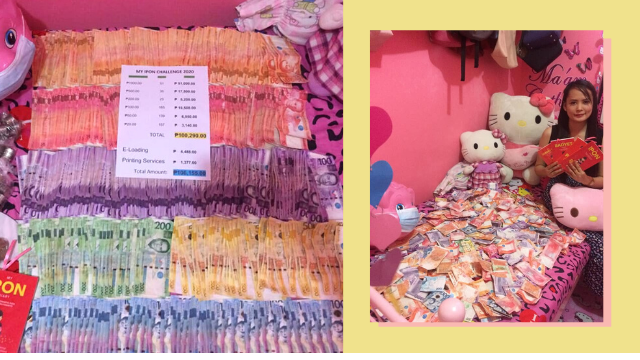

In an interview with Female Network, Cath revealed that her initial target was only P60,000, which she would accumulate by stashing 50 pieces of 20-peso, 50-peso, and 100-peso bills, as well as 45 pieces of 200’s, 35 of 500’s, and 25 of 1,000’s inside her pink piggy bank.

“Noong una talaga, P60,000 lang ang target amount ko sa ipon chart na ginawa ko. Pero tinuloy-tuloy ko lang siya at umabot siya ng P106,155 sa loob ng one year,” Cath said. “Gumawa po ako ng ipon challenge chart wherein I will earn P60,000 if I complete the challenge.”

The Nueva Ecija-based iponarya understands, taking on anipon challenge (or saving in general) may seem difficult. So, she shared other tried-and-tested tips on doing it with ease.

Tip #1: Teach yourself about money

While being financially literate is not a pre-requisite to saving up, educating yourself even on the basics would put you on right track. Cath said it matters, especially for people like her who used to struggle financially.

“Gusto ko talaga magkaroon ng sariling bank account na ang pera ay galing sa pinaghirapan ko. Ayoko na maranasan ‘yung hirap ng buhay ng pamilya ko noon na kailangan pang mangutang pang-tuition at baon,” she revealed to Female Network.

Cath then began beefing up her knowledge with tips from financial experts like Chinkee Tan and “Facebook groups ng mga iponaryo.” She continued, “‘Yung learnings from the books of Coach Chinkee Tan inspired me a lot para magipon. Ang daming learnings doon na nai-apply ko sa buhay ko at naging financially responsible ako na dati hindi ko nagagawa.”

Tip #2: Allocate a specific amount for your savings

The first thing that Cath does upon receiving her salary is to write down a budget list. Having a “financial management system” is important “para ‘di ka nagtataka kung saan ba napunta ang pera mo,” she said.

For that, she follows the formula “salary-savings=expenses” wherein her savings amounts to 10% of her salary. “Binubukod ko na ‘yun at hindi ko siya dapat gastusin. P1,500 lang ‘yun monthly na diretso na sa alkansya,” she said.

After that, Cath splits up the remaining amount between her parents’ allowance and other expenses, then puts the cash inside a “budget wallet organizer.”

“Kung may matitira pang pera bago ang payday, ise-save ko pa din,” she added.

Tip #3: Live within your means

All goals require sacrifice and for Cath, that means prioritizing her necessities over luxuries. “Dapat alam mo ang pinagkaiba sa kailangan mo at gusto mo lang. Unahin ang mga needs over wants. Isantabi ang mga bagay na kaya mo naman mabuhay kahit wala ‘yun kasiluho now, luha later,” she wrote on her Facebook post on January 2, 2020.

This involves fighting the urge to splurge on a new gadget or “adding to cart” again and again whenever there’s a sale online. Cath explained, “‘Di bali nang walang iPhone basta may ipon. Hindi ako nagu-upgrade ng cellphone basta nakaka-text, nakaka-call, nakaka-FB, at nakaka-selfie. Iwasan mo din ‘yung mga doble–dobleng number tulad ng 11:11 at 12:12. Learn to live within your means.”

Cath also lessened her daily expenses by choosing home-cooked meals over fast food and driving to school with her own electric bike instead of taking public transportation.

“Isang taon akong nagbabaon ng lunch saschool kung ano ulam sa bahay, ‘yun din ang ulam ko. Free ang meryenda saschool ‘pagteaching staff kaya less gastos,” she said on her post. “Bumili din ako ng school service na e-bike at nakakatipid ako ng P1,500 a month sa pamasahe. I-charge ko lang ng eight hours, nagagamit ko na siya ng one and a half week tapos P200 lang ang approximate na konsumo niya sa kuryente sa loob ng isang buwan. O ‘di ba, bongga. Bawi ko na ang pinambili sa laki ng natipid ko.”

Tip #4: Be a wise spender

While Cath made it a point to spend only on things that she needs, the iponarya also knows the value of treating yourself to little luxuries.

“Hindi ako maluho na tao. Inuuna ko muna ‘yung mga needs bago ang wants, simpleng pamumuhay, pero syempre, hindi ko kinakalimutan i-treat at bigyan ng reward ang sarili ko big or small accomplishment man ang nagagawa ko,” she told Female Network.

The key, she said, is to do it in limitation. “Just be a kuripot (wise spender) dahil ang pera mo ay hindi pinupulot at syempre, kapag wala kang bisyo, sigurado ang inyong pag-asenso,” she added.

Tip #5: Find other sources of income

Some people would think that stretching one’s paycheck beyond ‘petsa de piligro’ is close to impossible, more so saving up. The answer to that, according to Cath, is finding other sources of income.

In addition to her salary, the money-smart teacher drew her savings from several side jobs: “May e-loading business ako, printing services sa bahay, at nago-online selling din ako ng pre-loved clothes namin ng hipag ko ‘pag may free time ako. Nag-invest din ako safruits business ng sister-in-law ko na kumikita naman kahit paano.”

Although engaging in all these tasks may require you to modify a thing or two about yourself, Cath assured that it will all be worth it.

“Inalis ko ang pagiging mahiyain dahil nahihiya ako noon mag-online selling. Nagingflexible ako at nagkaroon ng time managementsa work at sa mgaextra sideline ko. Kailangan lang talaga ng dedication para mareach yung ipon goal mo,” she said.

Other popular ipon challenges

Aside from Cath’s P60,000 ipon challenge, another easy way to start your savings is through the “Invisible 50 challenge” wherein you put away every 50-peso bill that you get in a day inside your coin bank for a year.

If your budget is tight, you can opt for the “Loose coin challenge.” Similar to the “Invisible P50,” this would require you to set aside every coin that you have—no matter if it’s P1, P5, or P10—for your savings.

Another would be the “52-week ipon challenge” that works by increasing your weekly input in a span of 52 weeks. If you saved P50 for this week, you must shove P100 into your piggy bank the following week, and so on.

What’s important, as Cath said, is to turn saving into a habit. “Keep on saving. It doesn’t matter how much. Just save kahit piso-piso pa ‘yan kasi walang1 million kung walang piso,” she advised. “Tiwala lang sa sarili na magagawa mo dahil if others can do it, you can do it also.”